All Categories

Featured

Table of Contents

The inquirer represents a customer that was a plaintiff in a personal injury issue that the inquirer picked part of this plaintiff. The offenders insurance provider concurred to pay the complainant $500,000 in a structured settlement that requires it to acquire an annuity on which the plaintiff will be detailed as the payee.

The life insurance coverage company releasing the annuity is a qualified life insurance policy company in New York State. N.Y. Ins. 500k annuity payout. Law 7702 (McKinney 2002) states in the relevant component that" [t] he function of this write-up is to supply funds to safeguard homeowner. recipients, annuitants, payees and assignees of.

annuity contracts,. provided by life insurance coverage companies, based on certain restrictions, versus failure in the performance of legal commitments due to the impairment of bankruptcy of the insurer releasing such. agreements." N.Y. Ins. Legislation 7703 (McKinney 2002) states in the relevant part that" [t] his short article shall put on.

annuity contracts,. provided to a resident by a life insurance policy company accredited to transact life or health and wellness insurance or annuities in this state at the time the policy, contract or agreement was released." N.Y. Ins. Legislation 7704 (McKinney 2002) states in the pertinent part that" [t] his write-up shall be liberally understood to impact the purpose under area seven thousand 7 hundred 2 of this short article.

" The Division has reasoned that an annuitant is the holder of the essential right given under an annuity contract and specified that ". [i] t is that right which is most qualified to defense in case of the impairment or insolvency of the insurer." NY General Counsel Point Of View 5-1-96; NY General Advice Point Of View 6-2-95.

Annuity Purchasing

The proprietor of the annuity is a Massachusetts company, the desired recipient and payee is a local of New York State. Considering that the above specified purpose of Write-up 77, which is to be liberally interpreted, is to safeguard payees of annuity agreements, the payee would be shielded by The Life insurance policy Business Warranty Company of New York.

* An immediate annuity will certainly not have an accumulation phase. Variable annuities issued by Safety Life insurance policy Firm (PLICO) Nashville, TN, in all states other than New York and in New York City by Safety Life & Annuity Insurer (PLAIC), Birmingham, AL. Stocks supplied by Investment Distributors, Inc. (IDI). IDI is the principal expert for registered insurance coverage items provided by PLICO and PLAICO, its associates.

Fixed Life Annuity

Investors need to carefully think about the financial investment goals, threats, fees and expenditures of a variable annuity and the underlying financial investment alternatives prior to investing. This and other information is included in the prospectuses for a variable annuity and its underlying financial investment options. Syllabus might be acquired by speaking to PLICO at 800.265.1545. compare fixed annuity rates. An indexed annuity is not a financial investment in an index, is not a safety and security or stock exchange financial investment and does not take part in any supply or equity financial investments.

The term can be three years, five years, 10 years or any number of years in between. A MYGA works by locking up a lump amount of money to enable it to collect interest. If you need to take out cash from an annuity before the build-up duration is over, you might have to pay charges called surrender costs.

Withdrawal From Annuity

If you choose to restore the agreement, the rates of interest might vary from the one you had actually initially accepted. Another alternative is to move the funds right into a different sort of annuity. You can do so without encountering a tax charge by utilizing a 1035 exchange. Due to the fact that rate of interest are established by insurance companies that market annuities, it is necessary to do your research before authorizing a contract.

They can postpone their taxes while still employed and not in requirement of additional gross income. Offered the existing high rates of interest, MYGA has actually ended up being a substantial part of retirement financial preparation - annuity marketing services. With the chance of rate of interest declines, the fixed-rate nature of MYGA for a set variety of years is very attracting my clients

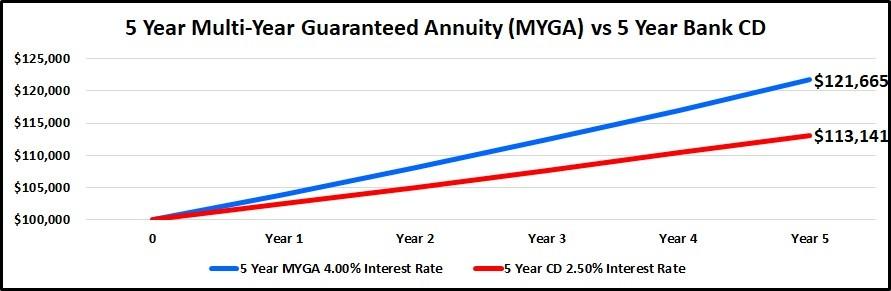

MYGA rates are typically higher than CD rates, and they are tax deferred which additionally improves their return. An agreement with more restricting withdrawal provisions might have greater prices. Several annuity suppliers offer penalty-free withdrawal stipulations that permit you to withdraw a few of the money from an annuity before the surrender duration finishes without having to pay costs.

In my point of view, Claims Paying Ability of the provider is where you base it. You can glimpse at the state guaranty fund if you want to, yet remember, the annuity mafia is watching.

They know that when they place their money in an annuity of any type of kind, the company is going to back up the insurance claim, and the market is overseeing that. Are annuities guaranteed?

If I put a referral in front of you, I'm likewise putting my certificate on the line. I'm really certain when I placed something in front of you when we talk on the phone. That does not indicate you have to take it.

10 Year Certain And Life Annuity

I totally comprehend that. But bear in mind, we're either marrying them or dating them. We have the Claims Paying Capability of the carrier, the state guaranty fund, and my close friends, that are unknown, that are circling around with the annuity mafia. How around that for a solution? That's a valid solution of somebody that's been doing it for a really, extremely lengthy time, and that is that somebody? Stan The Annuity Male.

People typically buy annuities to have a retired life income or to develop financial savings for another purpose. You can purchase an annuity from a certified life insurance policy agent, insurance provider, monetary organizer, or broker. You need to talk with a financial consultant about your needs and objectives prior to you get an annuity.

Spda Annuity

The difference between the two is when annuity settlements start. enable you to conserve money for retirement or other reasons. You do not have to pay tax obligations on your revenues, or payments if your annuity is a specific retired life account (IRA), until you take out the revenues. permit you to produce an earnings stream.

Deferred and prompt annuities use several options you can pick from. The choices supply various levels of potential threat and return: are assured to earn a minimum interest rate.

Variable annuities are higher threat since there's a possibility you could shed some or all of your cash. Set annuities aren't as high-risk as variable annuities since the financial investment risk is with the insurance coverage company, not you.

Amount Of An Annuity

If efficiency is reduced, the insurer bears the loss. Fixed annuities guarantee a minimal rates of interest, typically in between 1% and 3%. The business could pay a greater rates of interest than the assured passion price. The insurance firm figures out the rate of interest prices, which can change monthly, quarterly, semiannually, or every year.

Index-linked annuities show gains or losses based on returns in indexes. Index-linked annuities are much more intricate than taken care of delayed annuities.

Each depends on the index term, which is when the business determines the interest and credit histories it to your annuity. The establishes exactly how much of the rise in the index will be utilized to determine the index-linked rate of interest. Other crucial attributes of indexed annuities consist of: Some annuities top the index-linked passion price.

The flooring is the minimal index-linked interest rate you will certainly earn. Not all annuities have a floor. All repaired annuities have a minimal surefire worth. Some firms utilize the average of an index's value instead of the worth of the index on a defined day. The index averaging may occur any type of time throughout the regard to the annuity.

The index-linked interest is included to your original costs quantity yet doesn't compound throughout the term. Various other annuities pay substance interest throughout a term. Compound interest is rate of interest gained on the money you saved and the rate of interest you gain. This suggests that passion currently credited likewise gains rate of interest. In either case, the rate of interest made in one term is usually worsened in the next.

Equity Indexed Annuities Complaints

If you take out all your cash prior to the end of the term, some annuities will not attribute the index-linked rate of interest. Some annuities might credit just component of the interest.

This is due to the fact that you birth the financial investment threat instead of the insurer. Your representative or monetary advisor can aid you determine whether a variable annuity is ideal for you. The Stocks and Exchange Commission identifies variable annuities as safeties since the efficiency is obtained from supplies, bonds, and various other investments.

Annuities Comparison

An annuity contract has 2 stages: a build-up phase and a payment stage. You have several choices on how you contribute to an annuity, depending on the annuity you acquire: permit you to select the time and quantity of the payment.

permit you to make the same payment at the same interval, either monthly, quarterly, or every year. The Internal Earnings Service (INTERNAL REVENUE SERVICE) manages the taxes of annuities. The IRS permits you to delay the tax on earnings up until you withdraw them. If you withdraw your revenues prior to age 59, you will most likely have to pay a 10% very early withdrawal charge along with the taxes you owe on the passion earned.

After the buildup phase finishes, an annuity enters its payment stage. This is occasionally called the annuitization phase. There are numerous alternatives for getting payments from your annuity: Your business pays you a repaired amount for the time stated in the contract. The firm pays to you for as long as you live, but there are none payments to your successors after you die.

Numerous annuities bill a charge if you take out cash before the payout phase. This penalty, called a surrender cost, is normally greatest in the early years of the annuity. The cost is frequently a percentage of the taken out money, and generally begins at around 10% and goes down annually till the abandonment duration mores than.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options Key Insights on Your Financial Future Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial St

Analyzing Strategic Retirement Planning Everything You Need to Know About Indexed Annuity Vs Fixed Annuity Defining What Is A Variable Annuity Vs A Fixed Annuity Features of Smart Investment Choices W

Understanding Fixed Interest Annuity Vs Variable Investment Annuity Everything You Need to Know About Financial Strategies Breaking Down the Basics of Indexed Annuity Vs Fixed Annuity Benefits of Choo

More

Latest Posts